Time-Varying Models in NSGEV

Yves Deville

2026-01-01

Source:vignettes/IntroTVGEV.Rmd

IntroTVGEV.RmdThis document was created with NSGEV 0.2.1.

Scope

The NSGEV package provides a class of R objects

representing models for observations following a Time-Varying

Generalized Extreme Value (GEV) distribution, usually block maxima, as

described in the chapter 6 of the book by Coles (Coles 2001). This class of models is named

"TVGEV". These models are specific Non-Stationary GEV

models: only slowly varying functions of the time can be used as

covariates. They can be fitted by using CRAN packages such as

ismev (Rpack_ismev?),

evd (Stephenson 2002),

extRemes (Gilleland and Katz

2016) and more. However with these packages, the particularities

of the Time-Varying context are not taken into account, and it is quite

difficult for instance to compute predictions. The TVGEV

class and its methods have the following features.

Return levels are easily computed for a given time.

The inference on return levels can be obtained by profile-likelihood, using a dedicated algorithm.

The return level specific to the time-varying framework of Parey et al (Parey, Sylvie and Hoang, Thi Thu Huong and Dacunha-Castelle, Didier 2010) can be computed as well as profile-likelihood confidence intervals on it.

Graphical diagnostics favour the ggplot system (Wickham 2016). The

autoplotandautolayerS3 methods are consequently used instead of theplotandlinesS3 methods of the classical graphics package.

The present vignette shows how models can be specified and fitted, and illustrates the use of the principal methods.

A simple linear trend on the GEV location

Data for illustration

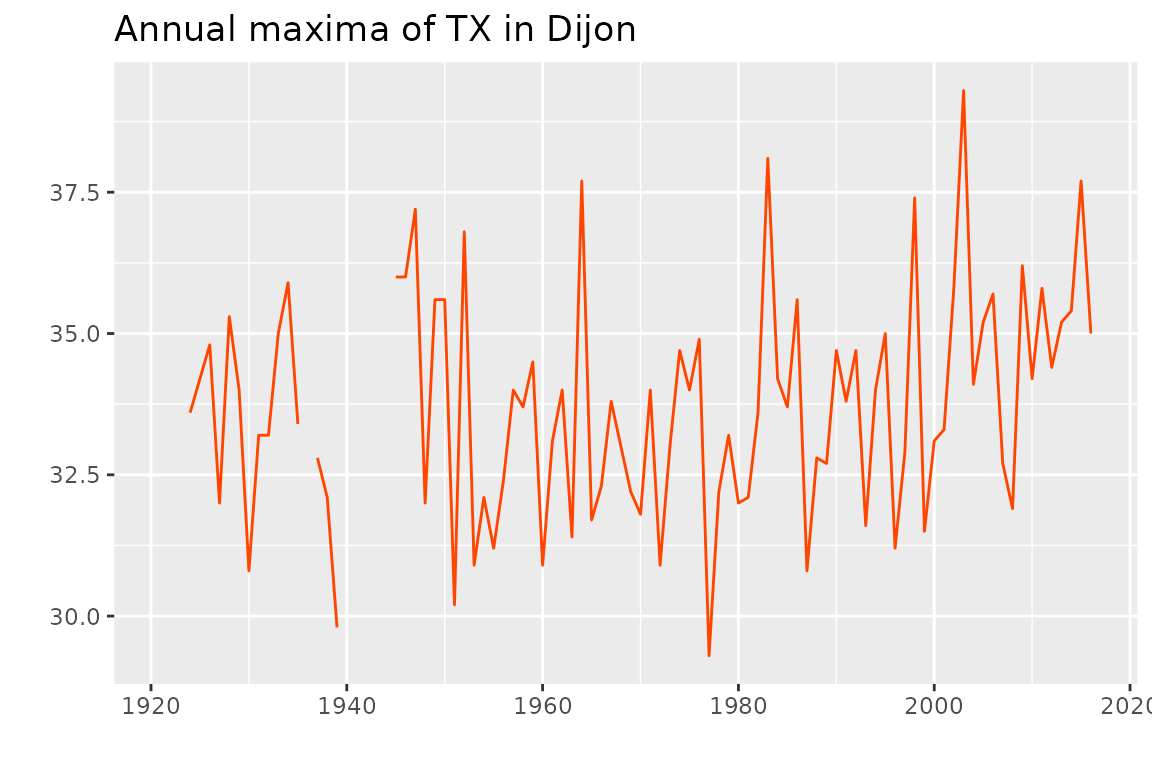

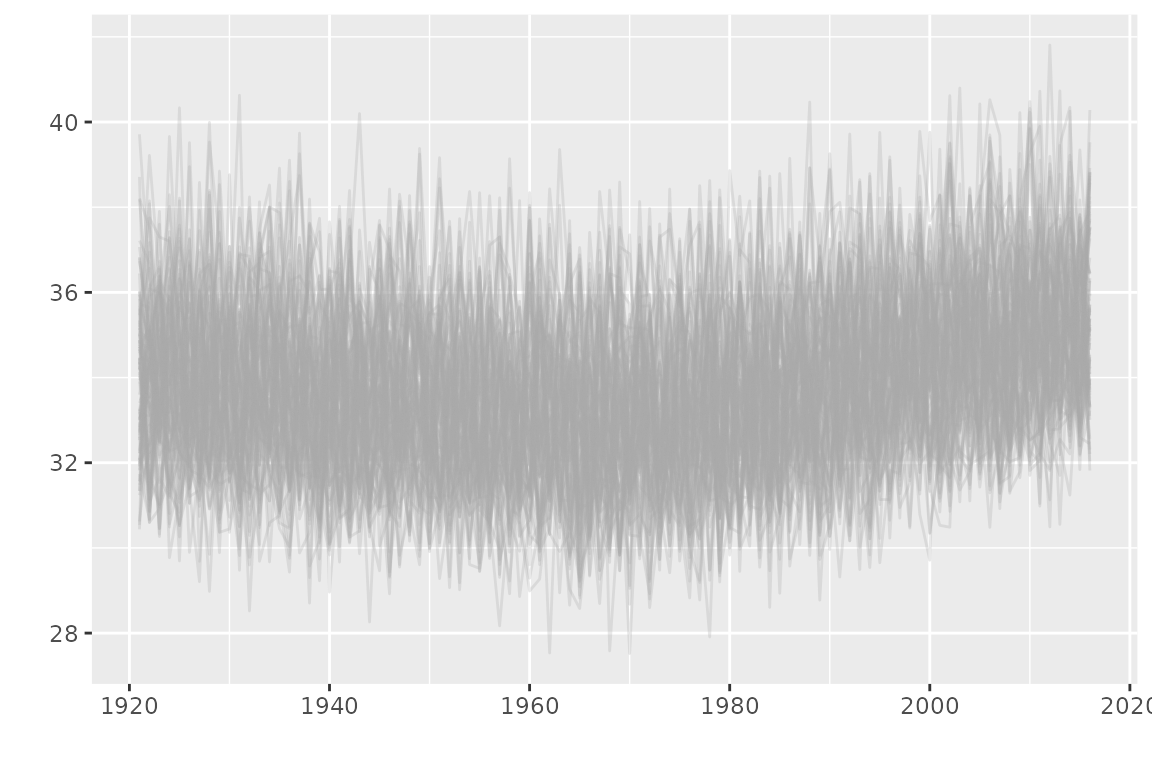

We begin by using the dataset TXMax_Dijon shipped with

the package.

head(TXMax_Dijon)## Year TXMax

## 1 1921 NA

## 2 1922 NA

## 3 1923 NA

## 4 1924 33.6

## 5 1925 34.2

## 6 1926 34.8The data represent the annual maxima of the daily maximal temperature

(TX) in Dijon (France). The time series is shown on the

next plot (R code not shown). The data are provided by European Climate Assessment and

Dataset.

The observations from 1980 on seem to be larger than that of the beginning of the series, motivating the use of a time-varying model.

Simple linear trend

As a possible model, a time-varying block maxima model relates the distribution of the response for the block (year) to the corresponding time , assuming that the observations are independent across blocks. We will assume here that has a GEV distribution with constant scale , a constant shape and a time-varying location . This model involves a vector of four unknown parameters.

We can fit this model by using several CRAN packages, for instance the extRemes package. With this package we need to exclude the missing values for the response

fite1 <- extRemes::fevd(x = TXMax,

data = subset(TXMax_Dijon, !is.na(TXMax)),

type = "GEV", location.fun = ~Year)Note that a classical formula is used to specify the model

as it is done for linear models with lm or

glm. By default, a formula implies the use of a constant.

So the formula ~ Year indeed implies the existence of the

coefficient

in

.

We could have used equivalently an explicit constant with

~ 1 + Year. On the contrary, a model with no constant

would have been specified by using the formula ~ Year - 1.

This convention is used by most model fitting functions requiring a

formula in the linear model fashion, and TVGEV will be no

exception.

By inspecting the content of the object or by reading the help, we can find the estimated values of the parameters

fite1$results$par## mu0 mu1 scale shape

## 5.07814887 0.01414038 1.84726804 -0.19990410

fite1$results$value## [1] 180.6135We see that the estimated location increases by about

1.41 Celsius by

century, with an intercept value

5.08 Celsius corresponding to the year

.

We extracted as well the negative maximized log-likelihood stored in the

element results$value.

To achieve nearly the same thing with the NSGEV

package, we need a little extra work: adding a column with class

"Date" to the data frame. Each observation of this date

column represents the beginning of a block. We can simply paste a month

and day indication -mm-dd to the year in order to get a

POSIX format

## [1] "Date"

head(df$Date, n = 5)## [1] "1921-01-01" "1922-01-01" "1923-01-01" "1924-01-01" "1925-01-01"Note that we no longer have to remove the observations with a missing response. Now we can fit the same model

fitNLin <- TVGEV(data = df, response = "TXMax", date = "Date",

design = polynomX(date = Date, degree = 1),

loc = ~ t1)

coef(fitNLin)## mu_0 mu_t1 sigma_0 xi_0

## 32.93752186 0.01527735 1.84567285 -0.20471258

logLik(fitNLin)## [1] -180.6005

## attr(,"df")

## [1] 4

## attr(,"nobs")

## [1] 87Note that we used a formula as before but now the covariate is a

function of the date which is computed by the design function, here

polynomX. The design function essentially returns a numeric

matrix, the column of which can be used as covariates. So the name of

the covariates depend on the design function used. This will be further

explained later.

The estimated parameters are nearly the same as before, except for

the first one - due to a different origin taken for the linear trend.

Indeed, the time origin for R Dates is "1970-01-01". The

maximized log-likelihood is extracted by using the logLik

method which works for many classes of fitted models.

The “fitted model” object has class "TVGEV", and a

number of classical S3 methods with simple interpretation are

implemented

class(fitNLin)## [1] "TVGEV"

methods(class = "TVGEV")## [1] anova autoplot bs cdf cdfMaxFun

## [6] coef confint density influence logLik

## [11] mean modelMatrices moment plot predict

## [16] print profLik psi2theta quantile quantMax

## [21] quantMaxFun residuals simulate summary vcov

## see '?methods' for accessing help and source codeFor example we can use the classical confint method to

display confidence intervals on the parameters

confint(fitNLin)## , , 95%

##

## L U

## mu_0 32.5048 33.3702

## mu_t1 -0.0005 0.0310

## sigma_0 1.5412 2.1502

## xi_0 -0.3489 -0.0605The results (by default based on the delta method) show that is within the interval on the slope , though being very close to the lower bound. The confidence interval on the shape suggest that this parameter is negative.

As is generally the case with the S3 class/methods system for R,

the methods should be used by invoking the generic function,

e.g. confint. However the help for the methods can be found

by using the “dotted” name such as ?confint.TVGEV. A method

implemented for a specific class usually has specific arguments that are

not found in the generic. For instance, the confint method

for the class "TVGEV" has a specific method

argument that allows choosing the inference method, with the three

choices "delta" (default), "boot" and

"proflik".

Stationary model with no trend

Quite obviously, we can fit a model with a constant trend by using the relevant formula

fitNConst <- TVGEV(data = df, response = "TXMax", date = "Date",

design = polynomX(date = Date, degree = 1),

loc = ~ 1)

coef(fitNConst)## mu_0 sigma_0 xi_0

## 32.94616 1.87935 -0.19645Since the design function is not used when the three GEV parameters

are constant, we can use TVGEV without its

design argument.

## mu_0 sigma_0 xi_0

## 32.94616 1.87935 -0.19645Note however that we still require that the response and the date are provided as columns of a data frame.

As a general rule, a time-varying model should always be compared to

a simpler model with three constant GEV parameters. For that aim, we can

perform a likelihood-ratio test, which is by convention attached to the

anova method in R.

anova(fitNConst, fitNLin)## Analysis of Deviance Table

##

## df deviance W Pr(>W)

## fitNConst 3 364.74

## fitNLin 4 361.20 3.5412 0.05986 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1The -value is > 0.05, so if we assume that there could be a global linear trend on the location, we would accept the null hypothesis at the level.

We can investigate different forms of trend, using different designs.

Designs and models

Example: polynomial design

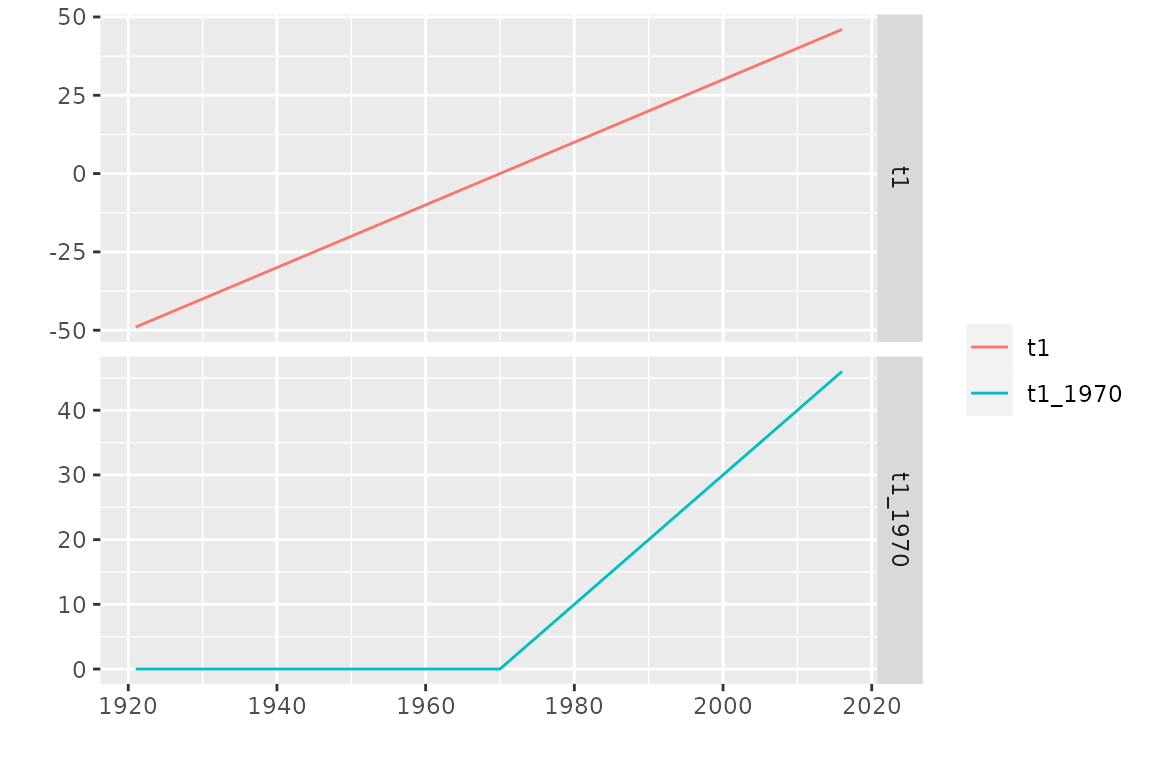

Now let us have a look at the design function polynomX

which was used before. We can call it using the date column of the data

frame df passed to the formal argument date of

the function.

## [1] "bts" "matrix"

head(X)## Block time series

##

## o First block: 1921-01-01

## o Last block: 2016-01-01

##

## date Cst t1

## 1921-01-01 1.00000 -48.99932

## 1922-01-01 1.00000 -48.00000

## 1923-01-01 1.00000 -47.00068

## 1924-01-01 1.00000 -46.00137

## 1925-01-01 1.00000 -44.99932

## 1926-01-01 1.00000 -44.00000The result is an object with class "bts", inheriting

from the class "matrix", with two columns. We guess that

the column named Cst is a column of ones as commonly used

in linear regression, and that the column t1 is a linear

trend in years with its origin set 49 years after 1921-01-01, so near

1970-01-01. Note that a TVGEV model does not need to use

all the basis functions of the design: we did not use the constant

Cst, because a constant basis function is generated by

default when the formula is parsed.

The class "bts" describes objects representing block

times series. It is quite similar to the "mts" class of the

forecast package. A few methods are implemented for

this class e.g. the autoplot method. To illustrate this

method, we consider a different design function involving broken line

splines, namely the function breaksX

The basis functions are now splines with degree

.

The first function named t1 is a linear function and for

each “break” date given in breaks, a broken line function

is added to the basis.

There are other design functions. These are consistently used in

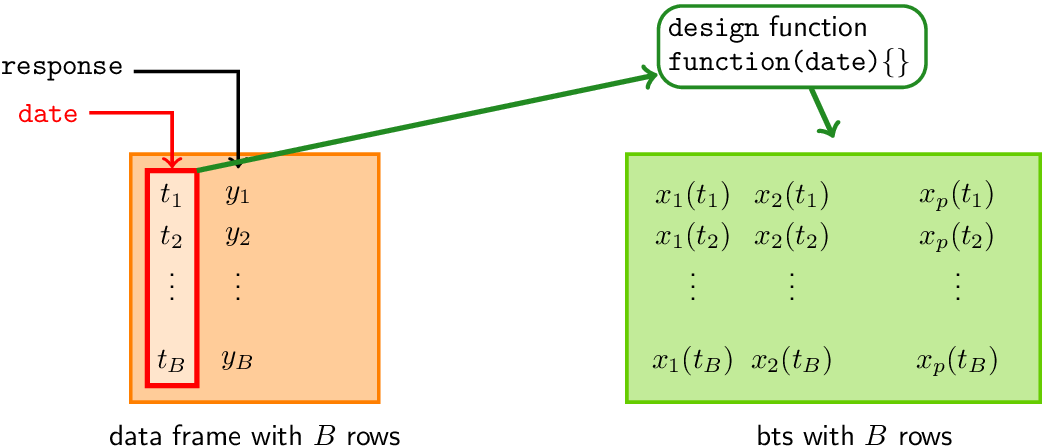

TVGEV as follows.

Using designs with TVGEV

With TVGEV

When the model is fitted, the data frame specified with the

dataformal argument must contain a column giving the date of the beginning of each block. The column name is specified by using thedateformal argument ofTVGEV.The date column is passed to a design function given in the

designformal argument. The value ofdesignis a call to the chosen function, using the chosen column ofdataas thedateof the design function.The block maxima model is specified through formulas linking the GEV parameters to the columns of the design matrix.

The fitted model object keeps track of the design function used and therefore can use it on a “new” period of time to make a prediction.

Broken line trend on the location

We can use the breaksX design function to specify a

continuous broken line form for the location

.

fitNBreak <- TVGEV(data = df, response = "TXMax", date = "Date",

design = breaksX(date = Date, breaks = "1970-01-01", degree = 1),

loc = ~ t1 + t1_1970)

coef(fitNBreak)## mu_0 mu_t1 mu_t1_1970 sigma_0 xi_0

## 32.06638460 -0.02392656 0.07728411 1.75541862 -0.18112018The location parameter now involves three parameters according to

where

is the “positive part” function and where

corresponds to the break point in time. Note that the slope of the

location

is given by

before the break point, and by

after that point. This corresponds to the two estimated slopes in

Celsius by century:

-2.4 (before break) and

5.3 (after). Since

represents the change of slope, we could decide whether the change of

slope is significant or not by querying whether a confidence interval on

contains

or not. Another solution based on anova is described

later.

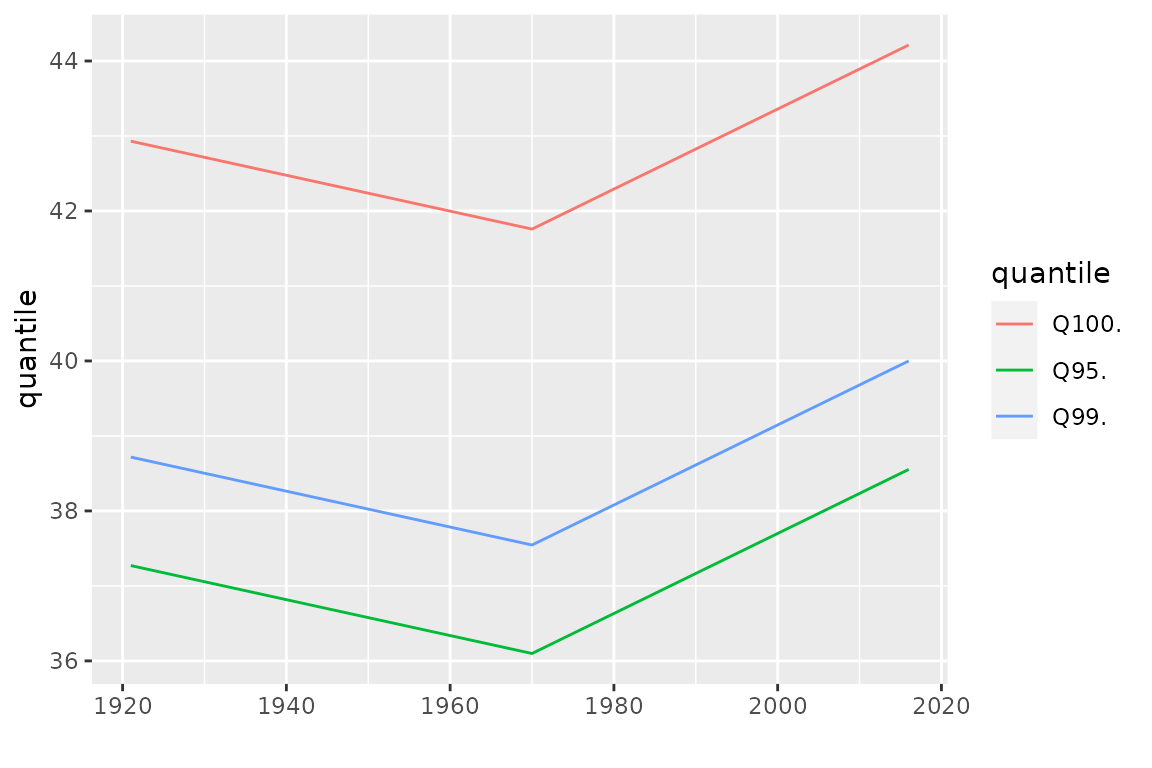

To assess the change in the distribution of

,

many graphical diagnostics can be produced with NSGEV.

For instance we can use the quantile method, which produces

a bts block time-series that can be autoplotted

Since the estimated value of the shape parameter is negative, all the GEV distributions for the observations are estimated as having a finite upper end-point . We can find this value by setting the probability to in the quantile function. Remind that we use the estimated distribution, so the shown upper end-point is the estimate . We could infer on the unknown value by using confidence intervals. The value of is the return level (conditional on ) corresponding to an infinite return period .

The two models corresponding to the objects fitNLin and

fitNBreak are nested: by setting

in the second model, we retrieve the first one. So we can perform a

likelihood-ratio test as above.

anova(fitNLin, fitNBreak)## Analysis of Deviance Table

##

## df deviance W Pr(>W)

## fitNLin 4 361.2

## fitNBreak 5 354.4 6.7982 0.009125 **

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1We see from the very small

-value

labelled Pr(>W) that the null hypothesis

must be rejected in favour of a break at the chosen break time as

defended by fitNBreak.

A limitation of the fitNBreak model is that the break

time can not be estimated simply. The same problem arises for the

Gaussian regression known as kink regression. So we can try

another basis of slowly varying functions which is flexible enough to

describe a smooth transition between two linear trends with different

slopes.

Natural spline basis

As a third example of design, we will use the natural spline

design as implemented by natSplineX. With this design, we

need to give two boundary knots as well as a number of knots between the

boundary knots. Along with its flexibility, an interesting property of

this basis is that the extrapolation outside of the boundary knots is

“only” linear. By using polynomials of degree

,

we would get a quadratic trend which becomes unrealistic even for a

small amount of extrapolation.

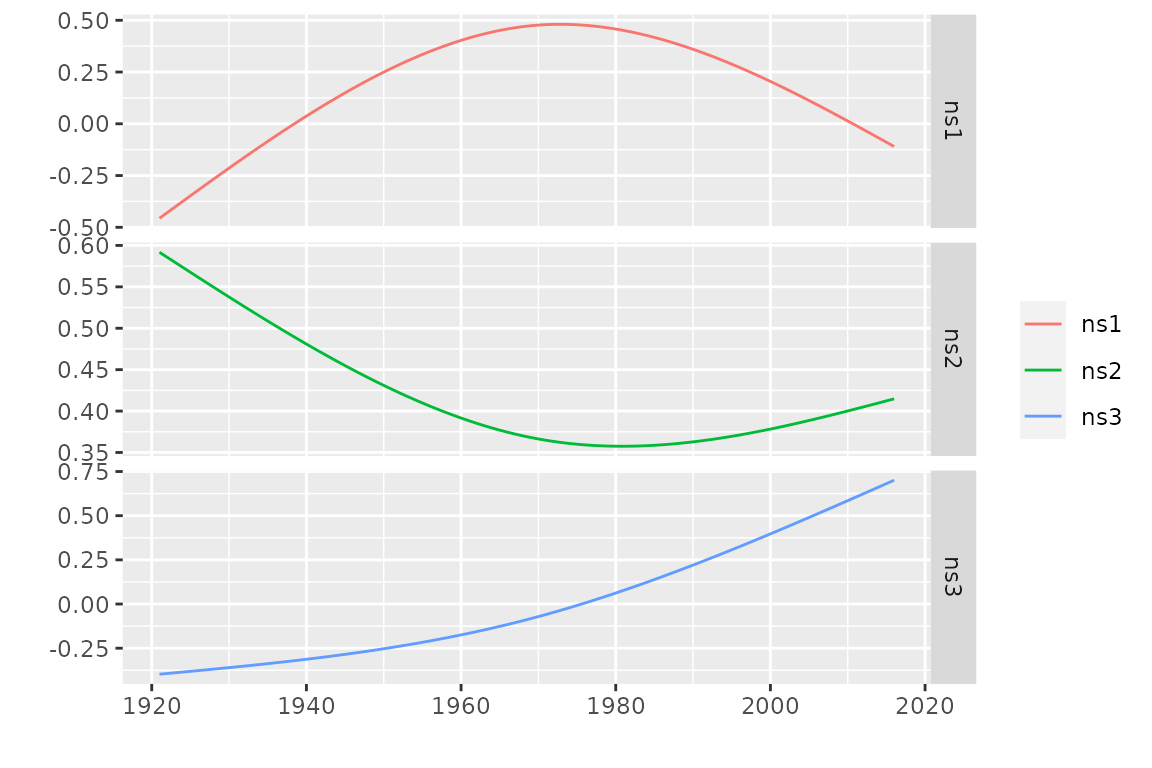

X1 <- natSplineX(date = df$Date, knots = "1970-01-01",

boundaryKnots = c("1921-01-01", "2017-01-01"))

autoplot(X1, facets = TRUE)

The basis functions are linearly independent but they span a linear

space which contains the constant

;

in other words, if we add a column of ones to unclass(X1)

we get a matrix with four columns but with rank

.

So we can either use a constant and two of the basis functions, or use

the three basis function but we then have to remove the default

constant as follows.

fitNNS <- TVGEV(data = df, response = "TXMax", date = "Date",

design = natSplineX(date = Date, knots = "1970-01-01",

boundaryKnots = c("1920-01-01", "2017-01-01")),

loc = ~ ns1 + ns2 + ns3 - 1)As before the models corresponding to fitNLin and

fitNNS are nested because the basis functions used in

fitNLin (the implicit constant

and the linear function t1) both are in the linear space

generated by the natural spline basis. So we can use the

anova method.

anova(fitNLin, fitNNS)## Analysis of Deviance Table

##

## df deviance W Pr(>W)

## fitNLin 4 361.20

## fitNNS 5 354.14 7.0651 0.00786 **

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Again we see that fitNNS fits the data significantly

better than fitNLin does. We can not compare the two models

fitNBreak and fitNNS by using

anova because they are no longer nested. However since

these two models have the same number of parameters, using AIC or BIC

would conclude to a slight advantage in favour of fitNNS

which has a slightly smaller deviance, hence a slightly larger

log-likelihood.

## Breaks Natural Spline

## 376.7323 376.4654Possible numerical problems

A possible source of problems, the design matrices created by the

design functions can take large values. Indeed, a date is considered as

a number of days for a given origin; for a long series we will get basis

functions with values of several thousands or even much more when

polynomials with degree

are used. In order to facilitate the task of maximizing the likelihood,

it is worth using the origin formal argument of the

provided design functions, setting it to a date close to the mean date

of the series.

Return levels and quantiles

Conditional return levels

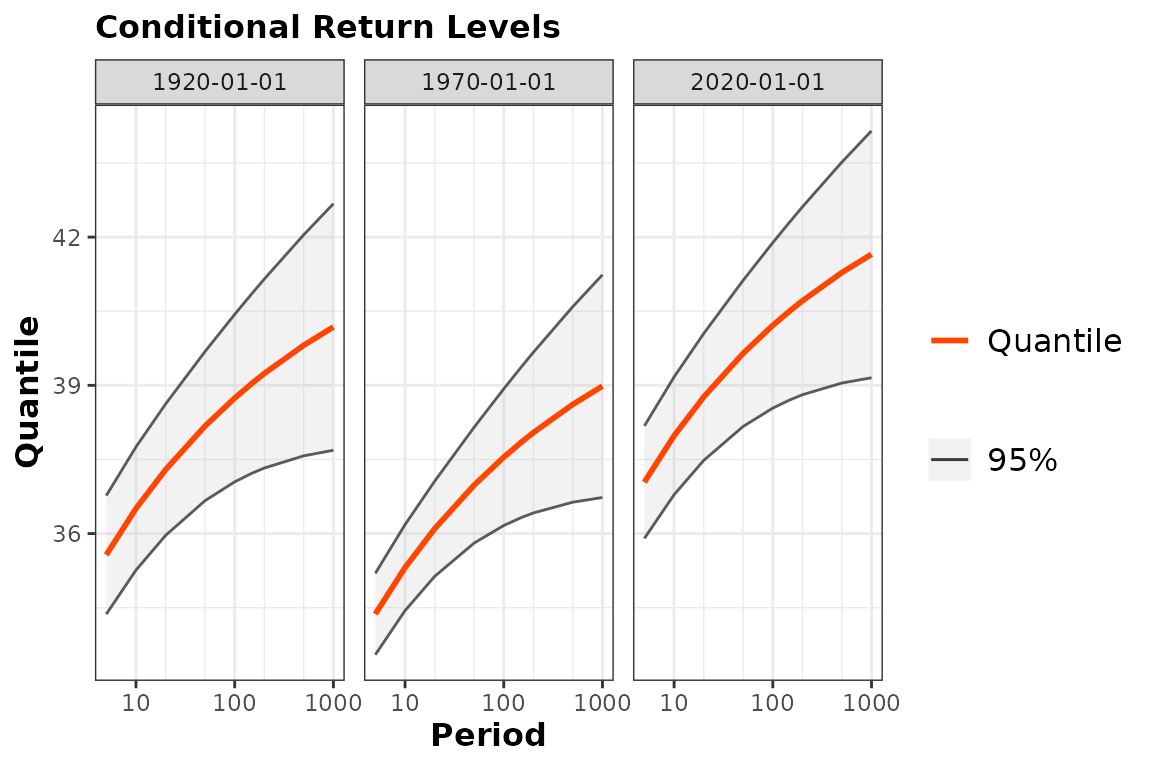

With time-varying models or non-stationary models, the concept of return level becomes quite messy, because many reasonable definitions can be given. The simplest return levels are the conditional ones, obtained by fixing a time and by considering the quantiles of the fitted distribution for that specific time.

pBreak <- predict(fitNBreak)## Since 'object' is really time-varying, the Return Levels

## depend on the date. A default choice of dates is made here.

## Use the 'newdate' formal to change this.

autoplot(pBreak)## Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

## ℹ Please use `linewidth` instead.

## ℹ The deprecated feature was likely used in the NSGEV package.

## Please report the issue at <https://github.com/IRSN/NSGEV/issues/>.

## This warning is displayed once every 8 hours.

## Call `lifecycle::last_lifecycle_warnings()` to see where this warning was

## generated.## ~Date

## <environment: 0x5645694884d8>

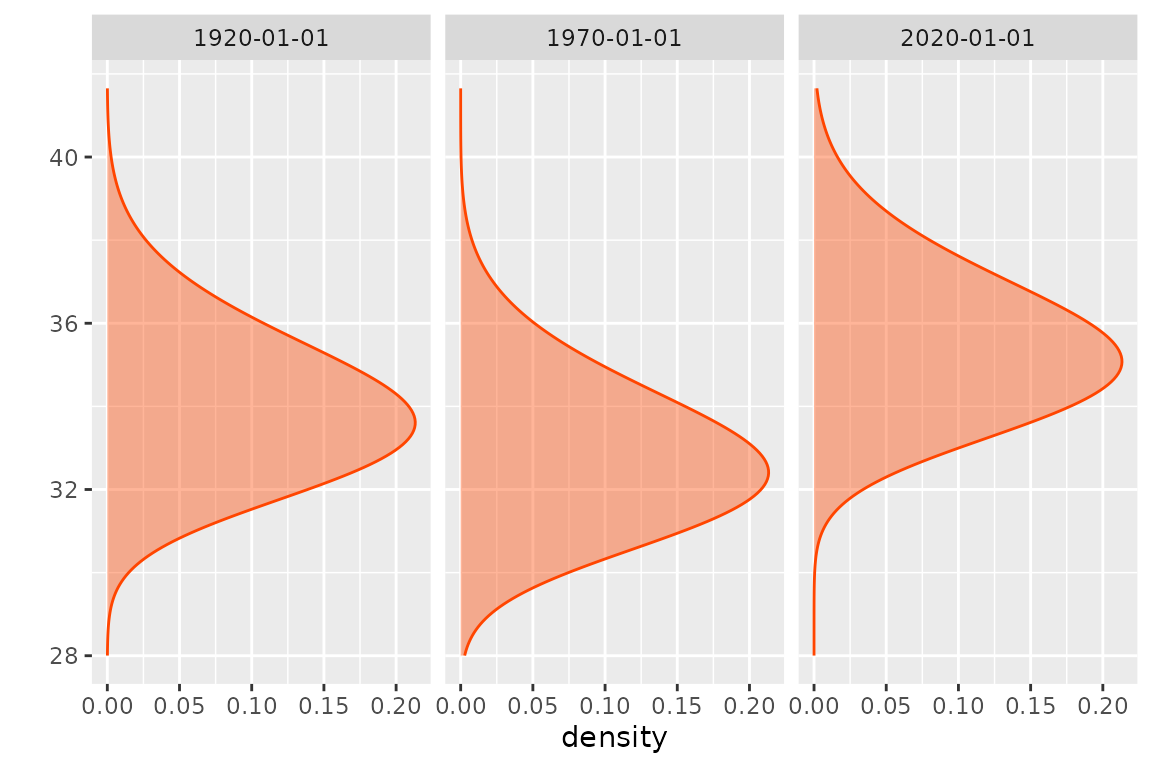

As suggested by the warning message, three “round” values are chosen

by default for the time

and the return level plots are shown for each of these in a specific

facet of the plot. Note that the axis could have used a probability of

exceedance on a yearly basis rather than a period in years. We can make

a different choice by using the newdate optional argument

of predict, see ?predict.TVGEV.

Confidence Intervals

Each of the return levels is computed with a confidence interval with

its default level set to

.

By default, the delta method is used, resulting in symmetrical

confidence intervals. Two alternative methods can be used by setting the

optional argument confintMethod: profile-likelihood and

bootstrap. With the profile-likelihood method, a constrained

optimization method is repeatedly used and convergence diagnostics are

printed by default. To save space we remove these by setting the

trace argument.

pBreakPL <- predict(fitNBreak, confintMethod = "proflik", trace = 0)## Since 'object' is really time-varying, the Return Levels

## depend on the date. A default choice of dates is made here.

## Use the 'newdate' formal to change this.

plot(pBreakPL)## Warning in plot.predict.TVGEV(pBreakPL): Inasmuch the plot is actually a

## 'ggplot', it is better to use the 'autoplot' method for consistency## ~Date

## <environment: 0x56456ba50028>Unconditional return levels

Unconditional return levels can be defined for the time-varying framework. These are obtained by aggregating several times corresponding to a prediction period. Many definitions are possible; a natural requirement is that the usual definition continues to hold when a stationary model is considered as time-varying.

Following Parey et al (Parey, Sylvie and Hoang, Thi Thu Huong and Dacunha-Castelle, Didier 2010), we can define the return level corresponding to years as the level such that the number of exceedances over in the “next years” has unit expectation . The notion of “next” year is relative to a time origin that can be chosen.

pUCBreak <- predictUncond(fitNBreak, newdateFrom = "2020-01-01",

confintMethod = "proflik", trace = 0)

plot(pUCBreak)## Warning in plot.predict.TVGEV(pUCBreak): Inasmuch the plot is actually a

## 'ggplot', it is better to use the 'autoplot' method for consistency

kable(pUCBreak, digits = 2)| Date | Period | Level | Quant | L | U |

|---|---|---|---|---|---|

| 2020-01-01 | 5 | 95% | 37.15 | 35.97 | 38.38 |

| 2020-01-01 | 10 | 95% | 38.23 | 36.95 | 39.62 |

| 2020-01-01 | 20 | 95% | 39.31 | 37.82 | 41.00 |

| 2020-01-01 | 30 | 95% | 40.04 | 38.33 | 42.01 |

| 2020-01-01 | 40 | 95% | 40.65 | 38.71 | 42.89 |

| 2020-01-01 | 50 | 95% | 41.22 | 39.03 | 43.72 |

| 2020-01-01 | 70 | 95% | 42.30 | 39.57 | 45.36 |

| 2020-01-01 | 100 | 95% | 43.90 | 40.29 | 47.85 |

For instance the return level corresponding to

years for the origin "2020-01-01" should be exceeded once

(on average) during the 30 years 2021 to 2050. This level is estimated

here to be 40.04 Celsius.

Note that an alternative definition of the return level can be

implemented as a function

of the parameter vector

of the model. Under quite general conditions, such a return level can be

regarded as a parameter of the model in a re-parameterization of it,

hence we can infer on it as we do for a parameter. To achieve this in

practice, the return level must be implemented as a R function with

signature function(object, psi) where object

has class "TVGEV" and psi stands for the

parameter vector. The profLik method can then be used to

infer on the return level using the profile-likelihood method, see

?profLik.TVGEV. This method can work for any smooth

function having the previous signature.

Quantiles of the maximum

Rather than trying to generalize the definition of a return level to the time-varying framework, one can simply consider the random maximum where the maximum is over a set of blocks. The most common case is when is a future period , , , such as the lifetime or design life (Rootzén and Katz 2013) of an equipment, and one want to assess a risk related to the possible exceedance over some high level during this period. Since the blocks are assumed to be independent we have

where the dependence on the parameter is through . Note that in general does not follow a GEV distribution.

The corresponding quantile function can be computed numerically either by solving or by interpolating from couples of values probability, quantile . For a given probability , the derivative of the corresponding quantile w.r.t. can be obtained by the implicit function theorem and can be used to infer on the quantile.

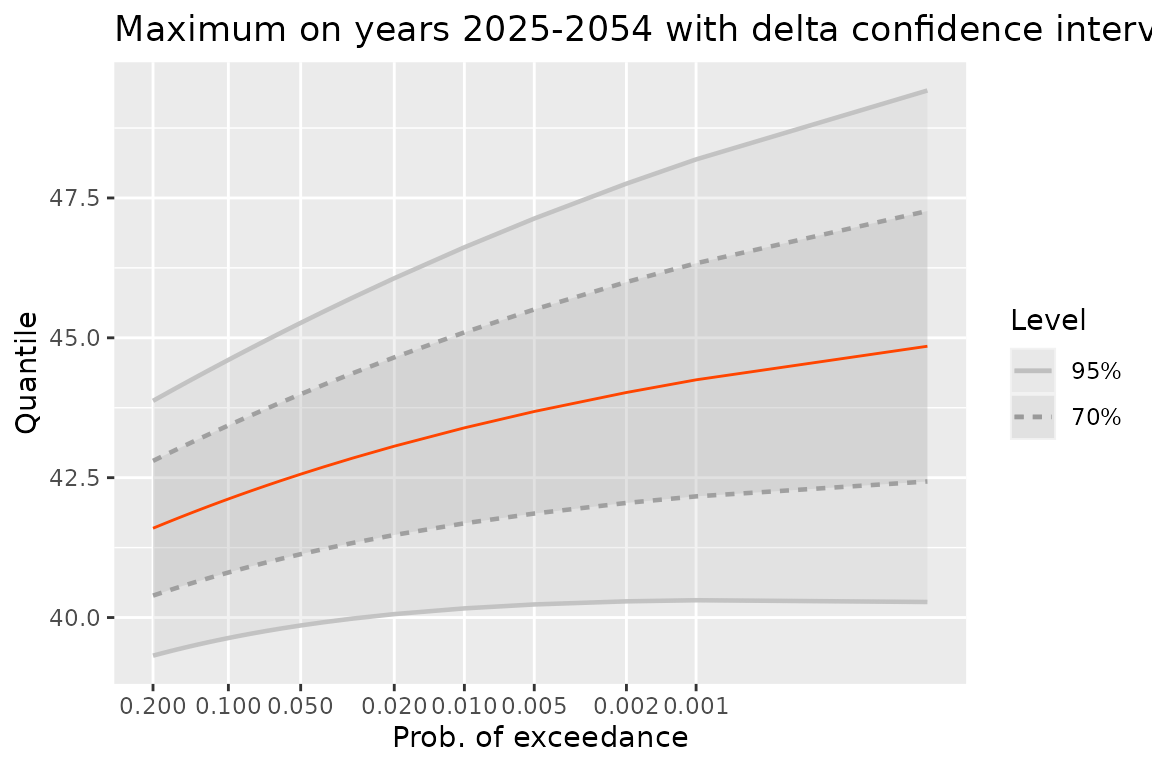

In NSGEV, the quantMax method can be

used to produce a table of values for the quantile function from a

TVGEV object. Such a table is given the S3 class

"quantMax.TVGEV" for which an autoplot method

has been implemented

newDate <- as.Date(sprintf("%4d-01-01", 2025:2054))

qM <- quantMax(fitNBreak, date = newDate, level = c(0.70, 0.95))

gqM <- autoplot(qM) +

ggtitle("Maximum on years 2025-2054 with delta confidence intervals")

print(gqM)

The plot shows the quantile against the probability of exceedance using a Gumbel scale. So if happens to be Gumbel (as can happen in the stationary case) the quantile line will be a straight line. When the period of interest is increased the maximum becomes stochastically larger. For instance, with a fixed beginning if the duration of the period is increased the maximum becomes stochastically larger: all quantiles are increased.

It is worth noting that as far as a small probability of exceedance is concerned, the expected value of the random number of exceedances over the corresponding quantile is . This approximation is acceptable when .

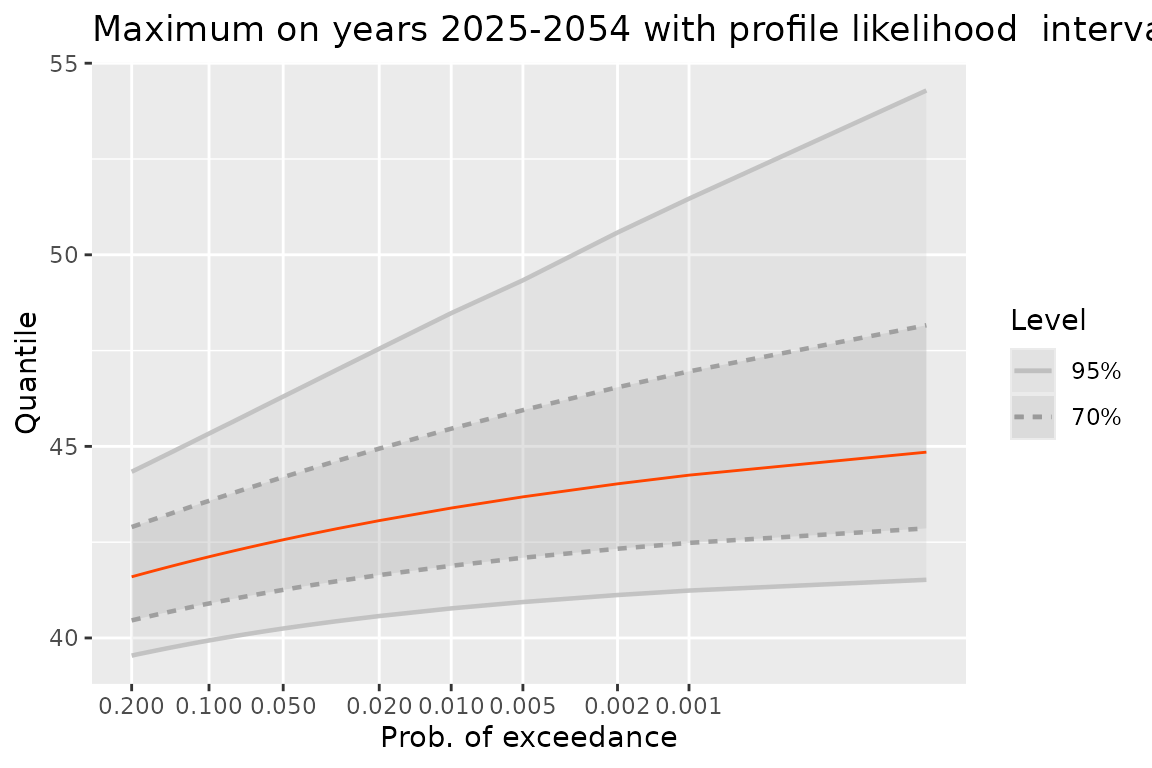

On the previous plot, confidence intervals based on the delta method are shown. It is now possible to use profile likelihood intervals, at the price of an increased computation time.

qM2 <- quantMax(fitNBreak, date = newDate, level = c(0.70, 0.95),

confint = "proflik")

gqM2 <- autoplot(qM2) +

ggtitle("Maximum on years 2025-2054 with profile likelihood intervals")

print(gqM2)

Needless to say, for a small probability of exceedance, the upper bound of the profile likelihood confidence interval is much larger than that of the delta interval.

Simulate from a fitted model

The simulate method is implemented in many R packages,

with the aim to simulate new data from a given model. It has been

implemented for the TVGEV class. A fitted model object can

be used to simulate new paths either for the fitting time period or for

a new one.

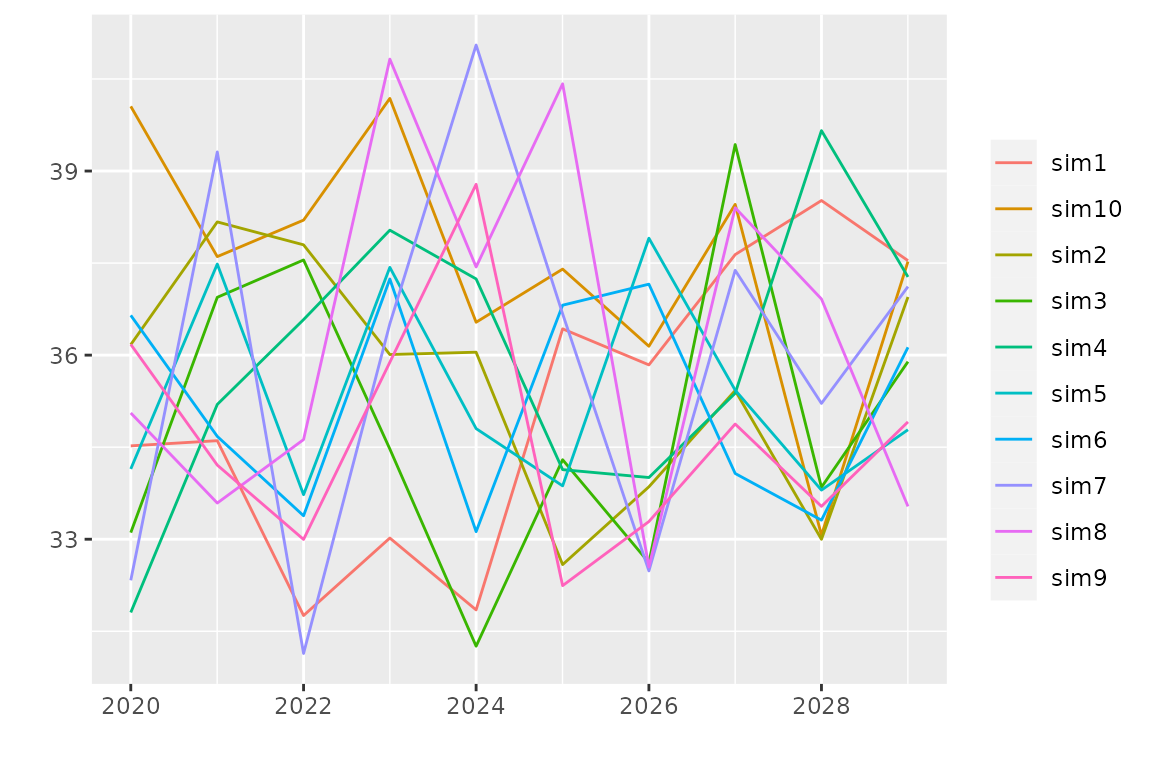

We can use a different period to better understand how the model anticipates new data

nd <- seq(from = as.Date("2020-01-01"), length = 10, by = "years")

autoplot(simulate(fitNBreak, nsim = 10, newdate = nd))

The simulated paths are here drawn in colour with a legend because

their number is small enough. Note that simulate is

functionally close to a prediction: the mean of a large number of

simulated paths is close to the expectation used in a prediction and the

uncertainty on the prediction can be assessed by using the dispersion of

the simulated paths.

More diagnostics and results

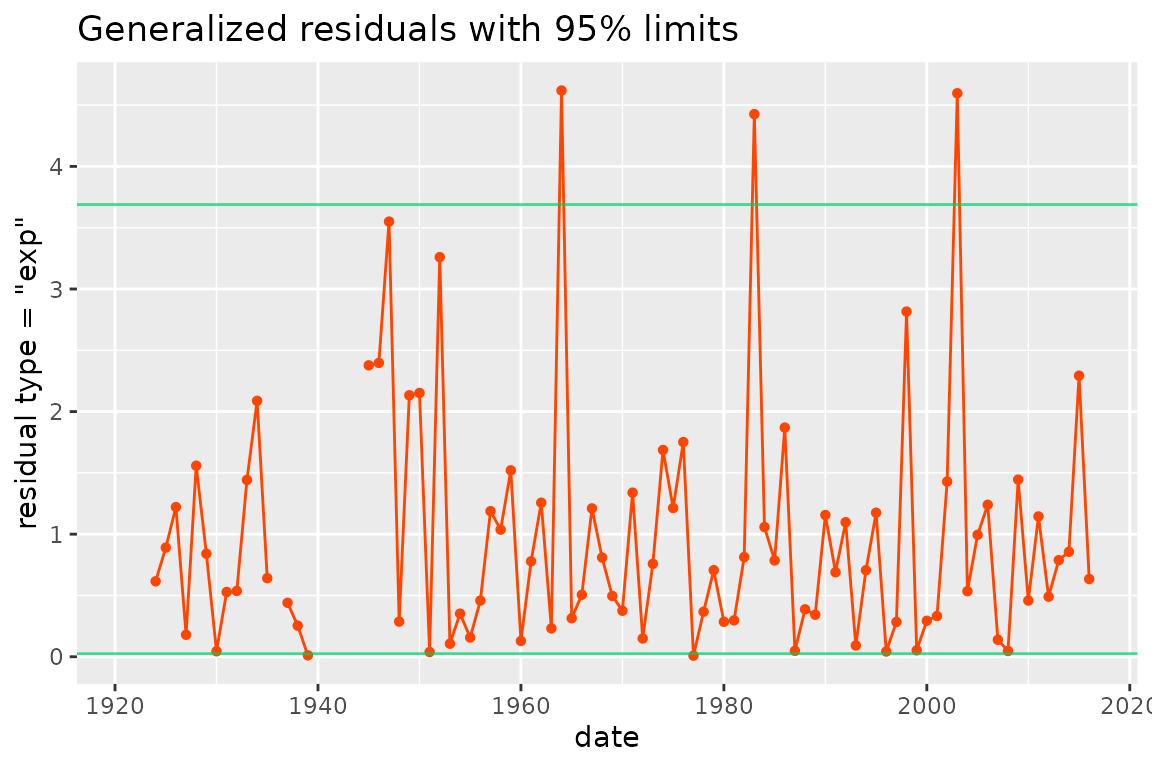

Residuals

The generalized residuals are random variables

related to the observations

,

so they form a block time-series. The distribution of

should be nearly the same for all blocks

and the dependence between the blocks should be weak (Cox and Snell 2018). Several definitions of the

residuals are possible, in relation with a target distribution. A simple

choice is

which should lead nearly to a uniform distribution on the interval

.

Other possible choices are

for a standard exponential target as used by Panagoulia, Economou, and Caroni (2014) and by

Katz, Parlange, and Naveau (2002), or

for a standard Gumbel target. Note that the resid method of

the package uses an increasing transformation so that

large/small residuals correspond to large/small observations. When the

GEV marginal distributions have a nearly exponential tail

using the standard Gumbel target for the generalized residuals can be

preferred because this will use a milder transformation of the data.

This is now the default choice.

The horizontal lines show an interval with approximate probability . The use of these residuals is similar to that in the usual linear regression framework where the distribution of the standardized residuals is close to the standard normal.

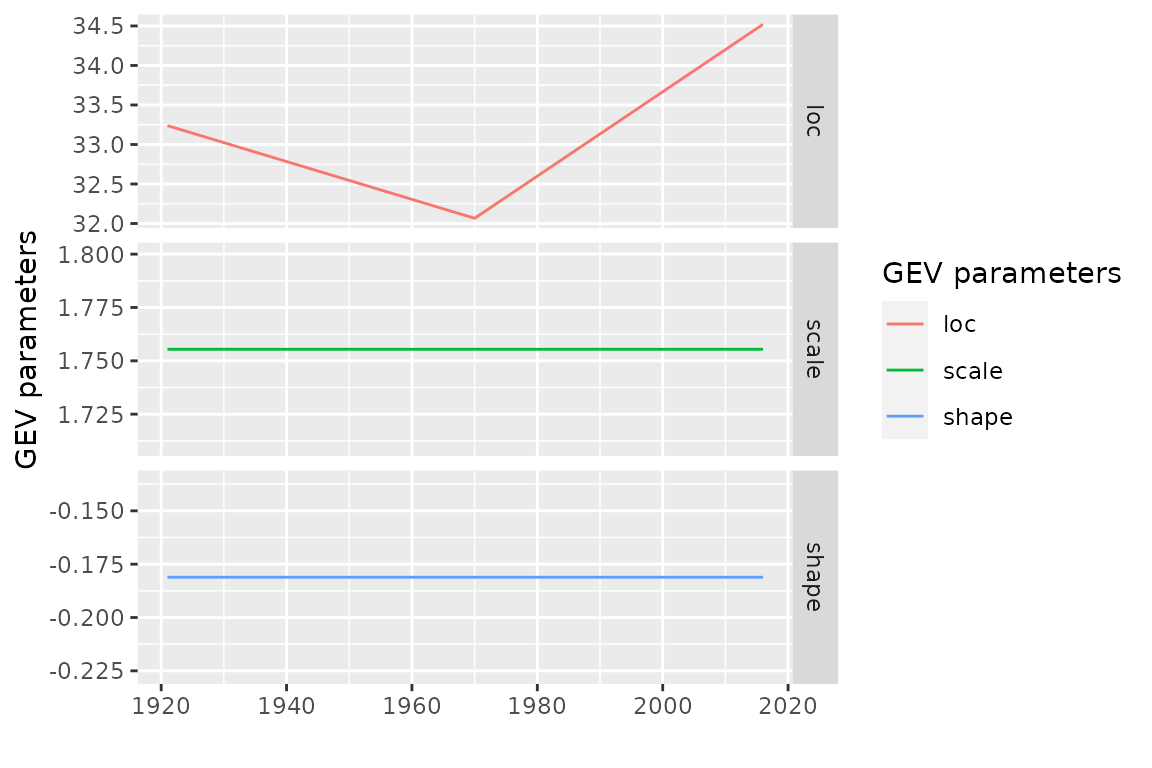

Parameters: “psi” vs “theta”

As shown before the parameters of the model can be extracted by using

the coef method. Using a non-standard terminology which

seems specific to the package, we can say that these are the “psi”

parameters. But we can be interested as well by the GEV parameters

,

and

that we can call “theta”

.

Since these parameters depend on the time

we can consider them as forming a block time series. We can “extract”

these parameters by using the optional formal type of the

coef method; this leads to a bts object that

can be autoplotted. Remind that the physical dimensions of the

parameters differ -

and

have the dimension of the

while

is dimensionless - so we have better show each series in a facet with

its own

axis.

Marginal distributions

Several methods can be used to assess the marginal distribution of

for a specific time

or at a collection of times given by a date argument. With

the default date = NULL, the methods quantile,

mean, moments for the class

"TVGEV" return time series objects that can be

“autoplotted” to plot the quantiles or the mean (expectation) against

the date as it was shown before. The help page with examples can be

displayed in the usual way, e.g. with ?quantile.TVGEV.

The density and cdf methods both return a

functional time series: a collection of functions depending on the date.

These can be autoplotted as well.

If needed, the time series with class "bts" can be

coerced into a standard time series inheriting from "ts"

for which many methods have been written in different packages.

Bootstrap

Principle

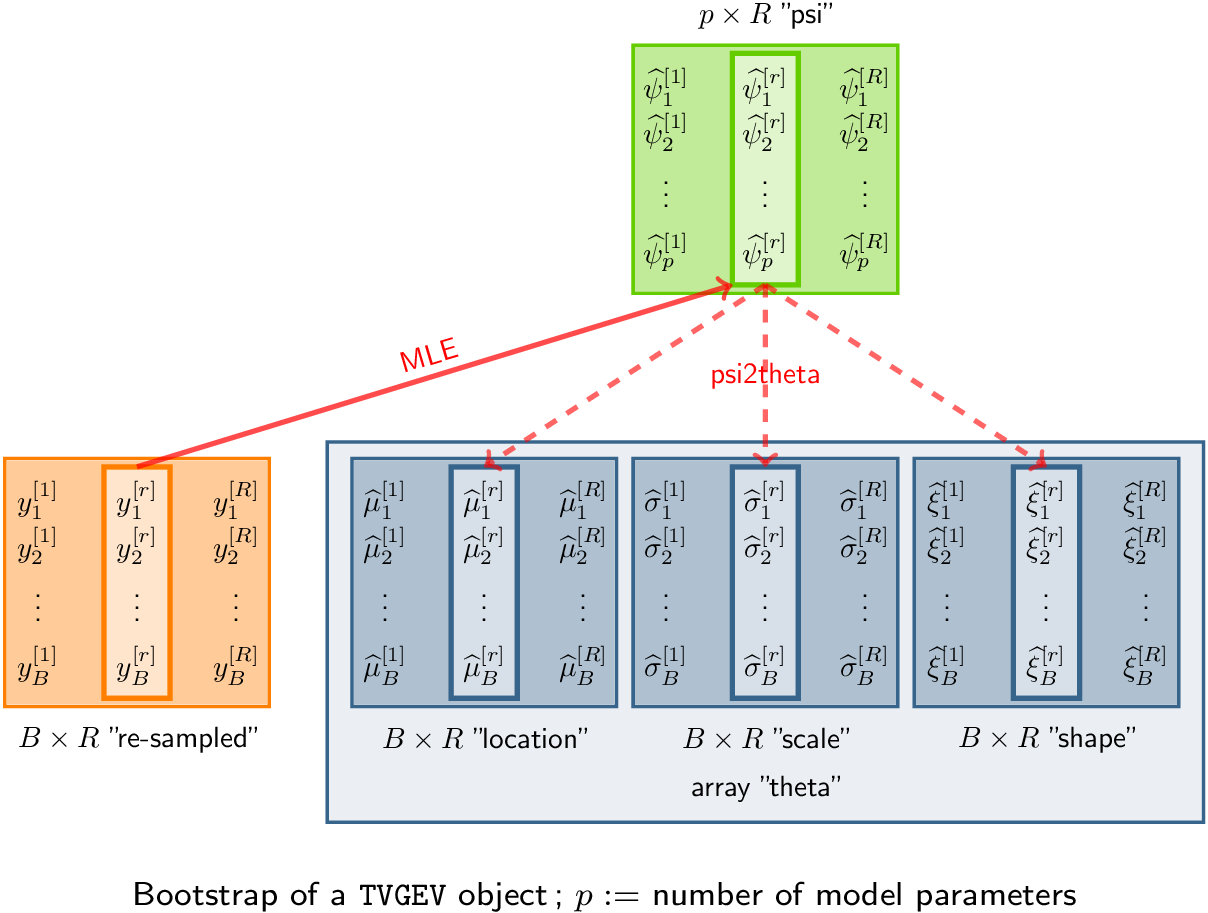

A large number of response vectors are simulated or “re-sampled” corresponding to , , . These simulated values can be stored into a matrix with rows and columns. For each vector , the MLE of the “psi” parameter vector is computed. The sample quantiles of the can then be used to provide a confidence interval on .

The bs method takes a TVGEV object as its

first argument and computes the bootstrapped “psi” parameters

.

These bootstrapped parameters are in fact stored as the rows of the

estimate element of the returned list.

myBoot <- bs(fitNBreak) ## The optimisation failed to converge. Hints: give `psi0`, try using `estim = "nloptr", give lower and upper bounds.## Warning in MLE.TVGEV(object, y = y[, b], estim = estim, ...): convergence not

## reached in optimisation

names(myBoot)## [1] "estimate" "negLogLik" "R" "optim" "type"

head(myBoot$estimate, n = 3)## mu_0 mu_t1 mu_t1_1970 sigma_0 xi_0

## [1,] 32.18540 -0.02209687 0.07976180 1.901520 -0.2294907

## [2,] 31.72127 -0.04716687 0.09096013 1.613856 -0.1025511

## [3,] 31.90407 -0.02768300 0.08830328 1.636649 -0.1734725Note that the default number of replicates R is very

small and has been set for a purely illustrative use. A well-accepted

choice

.

It is easy to derive from the theta parameters the corresponding

block times series of “thetas”

.

Broadly speaking we have to apply the function psi2theta to

each line of the matrix returned as the estimate element of

the result.

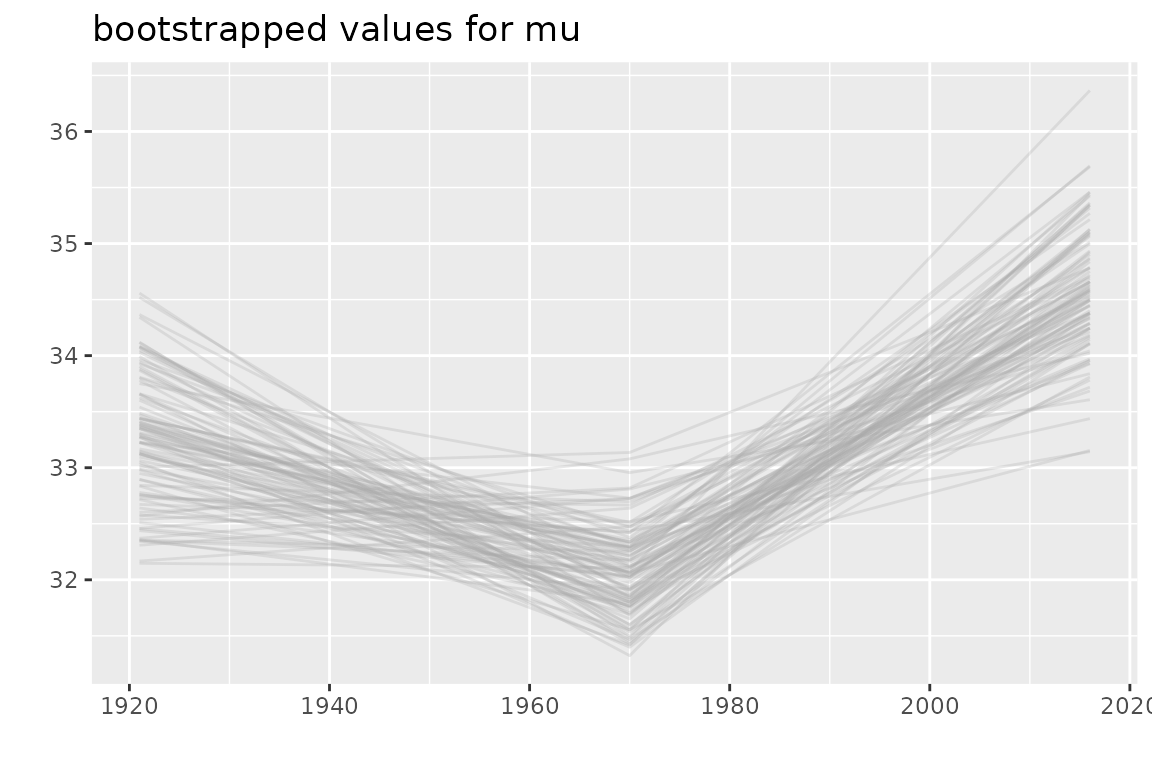

mu <- apply(myBoot$estimate, MARGIN = 1,

FUN = function(x, model) psi2theta(psi = x, model = model)[ , 1],

model = fitNBreak)

autoplot(bts(mu, date = fitNBreak$fDate)) + ggtitle("bootstrapped values for mu")

One the bootstrapped values for the “psi” parameters have been

computed, they can be used to later infer on the return periods at a

short computing cost. In that aim, a new element named boot

must be added to the fitted model.

fitNBreak$boot <- myBootNote however that this is a kind of “hack”. Some care is needed to

ensure that the new boot element is consistent with the

right fitted model using the right data.

Since most modern computers use multicore processors, a parallel

computation can be used to achieve substantial saving in the computing

time. See the example in the help page of boot.ts to see

how this can be achieved.

Details how resampling is performed

Two methods can be used to “resample” (Panagoulia, Economou, and Caroni 2014)

Parametric. For , , , the value is drawn as where is the MLE of the vector of the three GEV parameters corresponding to the block , which is a function of .

Non-parametric. For , , , the generalized residuals are resampled to form a vector with the wanted size . Each residual is back-transformed to a response .

The second method is also known under the names fixed- resampling and resampling from the residuals.

The bootstrap can also be used to infer on the return levels, either conditional or unconditional. For example, the conditional return level corresponding the the period of blocks and for the given time can be inferred by using the quantiles of the return periods which are computed as for .

Strengths and limitations of TVGEV

The "TVGEV" S3 class and its dedicated methods allow a

simple use of time-varying GEV models, including prediction. Some

functionality of the package such as the simulation are not found in

more classical packages, to our best knowledge. However

Only known functions of time can be used as covariates.

Each of GEV parameters can only depend on the time covariates through a linear function of these.

The parameters can not be share across GEV parameters.

To illustrate 1., we can not use a binary variable indicator of a site in order to build a regional model. To illustrate 2., the GEV location can be but not have the form . To illustrate 3., we can not have both and , because the parameters and are then used both by the location and the scale .

Appendix

Coping with dates

In practice, the time will be represented by a date object,

and the POSIX format "yyyy-mm-dd" or in R

"%Y-%m-%d" will be favored. The R base

package has a "Date" class which is used by

NSGEV

## [1] "Date"

myDate## [1] "2020-01-01"

format(myDate, "%d %B %Y")## [1] "01 January 2020"

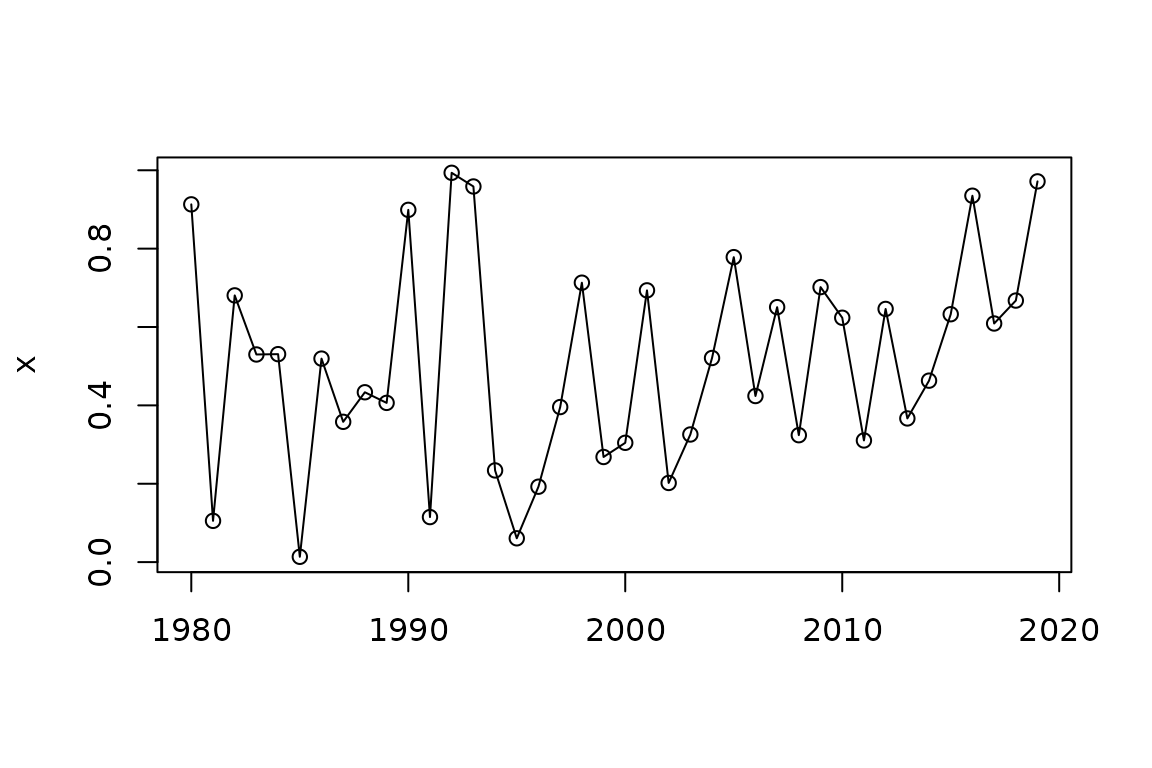

myDate <- seq(from = as.Date("1980-01-01"), by = "years", length = 40)

x <- runif(length(myDate))

plot(myDate, x, type = "o", xlab = "")

The lubridate package (Grolemund and Wickham 2011) has functions that can help to cope with date.

Adding new design functions

You can add new design functions. A design function:

Must have its first argument named

date. This argument is intended to be passed either as an object with class"Date"or as an object which will be coerced automatically to this class by usingas.Date. For instance, a character vector in POSIX format should work.Must return a matrix with the basis function as its columns. It must also have an attribute named

"date"containing the date vector. This object should be created either by using thebtsfunction (creator for the class) or by simply giving the classc("bts", "matrix")to a matrix with the suitable attribute.

Estimating the break with a broken line trend

Let us consider again the broken line trend discussed above, namely

As mentioned before, the date

of a change of slope can be considered as an unknown parameter, but the

model then no longer has the form for TVGEV objects, so it

can no longer be estimated by using directly the TVGEV

function. Yet we can find the value of

by maximizing the log-likelihood over a vector of candidate values:

estimating a TVGEV model for each value will provide the

corresponding log-likelihoods. For a given year we can create a suitable

formatted date with the sprintf function as follows

yearBreaks <- c(1940, 1950, 1955, 1960:2000, 2005, 2010)

res <- list()

for (ib in seq_along(yearBreaks)) {

d <- sprintf("%4d-01-01", yearBreaks[[ib]])

floc <- as.formula(sprintf("~ t1 + t1_%4d", yearBreaks[[ib]]))

res[[d]] <- TVGEV(data = df, response = "TXMax", date = "Date",

design = breaksX(date = Date, breaks = d, degree = 1),

loc = floc)

}## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

## at the best found in an environment differing from `data`.

## Warning in TVGEV(data = df, response = "TXMax", date = "Date", design = breaksX(date = Date, : 'design' uses variables not in `data`: `d`.

## This may be a source of problems in scoping, because these variables are

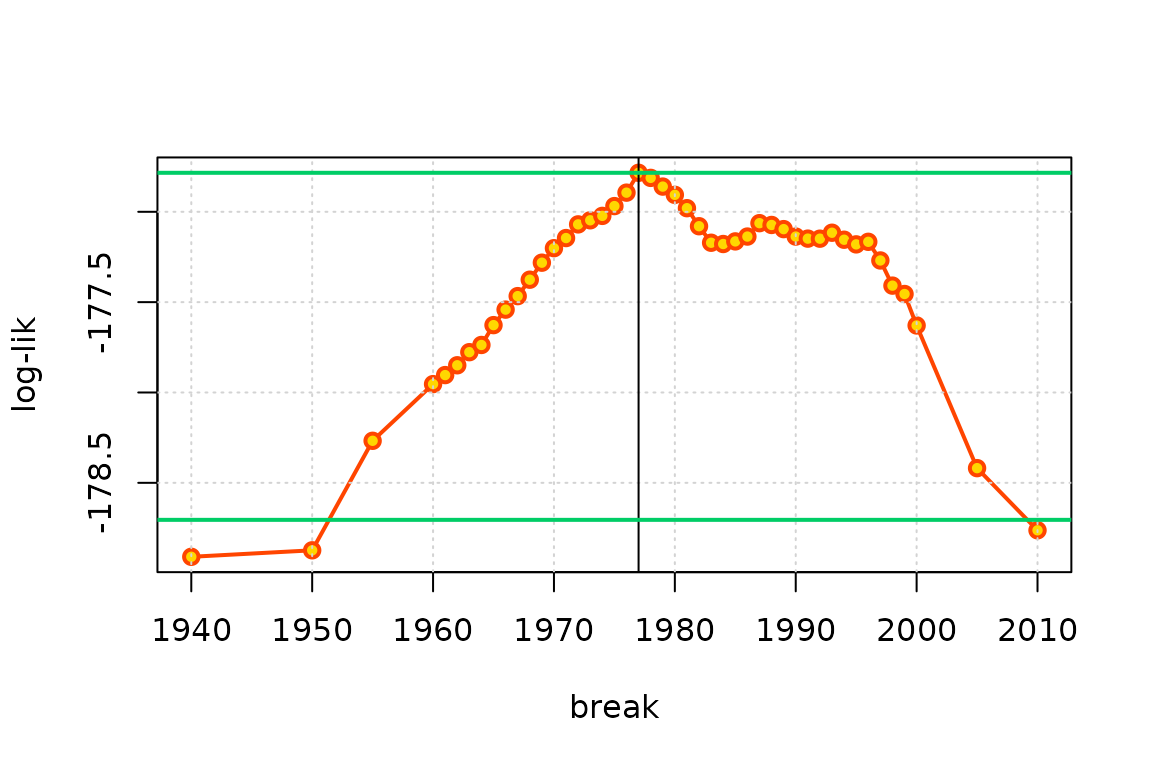

## at the best found in an environment differing from `data`.We now have a list res of

length(yearBreaks) objects and the log-likelihood of each

object can be extracted by using logLik. So we can plot the

log-likelihood against the year and find the “best” object with maximal

log-likelihood.

ll <- sapply(res, logLik)

plot(yearBreaks, ll, type = "o", pch = 21, col = "orangered",

lwd = 2, bg = "gold", xlab = "break", ylab = "log-lik")

grid()

iMax <- which.max(ll)

abline(v = yearBreaks[iMax])

abline(h = ll[iMax] - c(0, qchisq(0.95, df = 1) /2),

col = "SpringGreen3", lwd = 2)

Although the points show a profiled log-likelihood, the regularity conditions that must hold in ML estimation are not fulfilled, because the log-likelihood is not differentiable w.r.t. . As a consequence, the usual level (shown as the lower horizontal line in green here) does not provide a confidence interval on the unknown .

Constraints on the parameters, fixed parameters

As an experimental feature, inequality constraints on the parameters

can be imposed. The constraints are simple “box” constraints of the form

where

and

are given. These constraints can only be used when the likelihood is

maximized with the nloptr package. If needed, they can be

given for some parameters only, letting the other bounds fixed at their

default values

and

.

In practice, the constraints are given by using a named vector, and

hence the names of the parameters must be known. These names can be

retrieved if needed by first using estim = "none".

fitNBreak2 <-

TVGEV(data = df, response = "TXMax", date = "Date",

design = breaksX(date = Date, breaks = "1970-01-01", degree = 1),

loc = ~ t1 + t1_1970,

estim = "nloptr",

coefLower = c("xi_0" = -0.15), coefUpper = c("xi_0" = 0.0))## Warning in MLE.TVGEV(object = tv, y = NULL, psi0 = psi0, estim = estim, : some

## estimated parameters at the bounds, inference results are misleading

coef(fitNBreak2)## mu_0 mu_t1 mu_t1_1970 sigma_0 xi_0

## 32.02318423 -0.02420594 0.07812270 1.72977928 -0.15000000The GEV shape parameter is usually taken as constant, not time-varying; inasmuch the log-likelihood is when , a lower bound should normally be set. In practice, this is usually not needed because for numerical reasons the optimization will converge to a local maximum with and a finite log-likelihood rather than to a parameter vector with the infinite maximal log-likelihood.

The constraints can be used to set a parameter to a given value by taking and .

fitNBreak3 <-

TVGEV(data = df, response = "TXMax", date = "Date",

design = breaksX(date = Date, breaks = "1970-01-01", degree = 1),

loc = ~ t1 + t1_1970,

estim = "nloptr",

coefLower = c("mu_t1" = -0.02, "xi_0" = -0.2),

coefUpper = c("mu_t1" = -0.02, "xi_0" = 0.1))## Warning in MLE.TVGEV(object = tv, y = NULL, psi0 = psi0, estim = estim, : some

## estimated parameters at the bounds, inference results are misleading

coef(fitNBreak3)## mu_0 mu_t1 mu_t1_1970 sigma_0 xi_0

## 32.13623265 -0.02000000 0.07108756 1.75700613 -0.18234029